All Categories

Featured

Table of Contents

In very general terms, unregulated safeties are believed to have greater dangers and greater incentives than controlled financial investment lorries. It is essential to keep in mind that SEC policies for certified investors are developed to safeguard investors. Unregulated securities can supply exceptional returns, however they also have the possible to produce losses. Without oversight from economic regulators, the SEC merely can't examine the threat and reward of these investments, so they can't offer information to enlighten the ordinary investor.

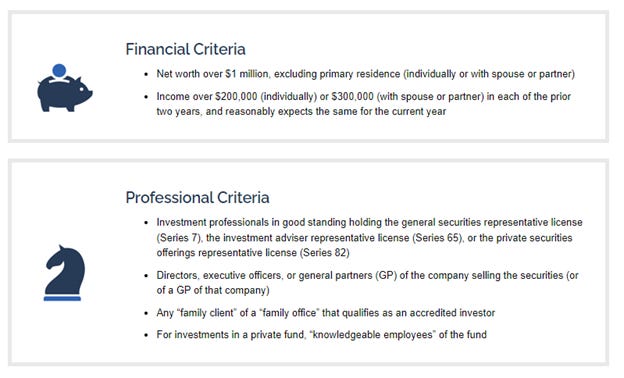

The idea is that capitalists that earn enough earnings or have adequate riches have the ability to take in the danger better than investors with lower earnings or less wealth. accredited investor investment opportunities. As an accredited financier, you are anticipated to finish your own due diligence prior to adding any kind of asset to your financial investment profile. As long as you fulfill one of the complying with four requirements, you certify as a certified financier: You have earned $200,000 or even more in gross earnings as a private, every year, for the previous 2 years

You and your spouse have actually had a combined gross earnings of $300,000 or even more, yearly, for the previous 2 years. And you expect this level of earnings to proceed. You have a web worth of $1 million or more, omitting the value of your primary house. This means that all your assets minus all your financial obligations (omitting the home you live in) total over $1 million.

Preferred Accredited Investor Funding Opportunities with Accredited Investor Returns

Or all equity proprietors in the company certify as recognized financiers. Being a recognized financier opens up doors to financial investment possibilities that you can not access or else. When you're approved, you have the option to invest in uncontrolled safety and securities, which consists of some outstanding investment possibilities in the property market. There is a variety of actual estate investing methods available to financiers that don't currently meet the SEC's requirements for accreditation.

Coming to be an accredited investor is simply an issue of verifying that you meet the SEC's needs. To validate your earnings, you can provide paperwork like: Earnings tax obligation returns for the previous 2 years, Pay stubs for the past 2 years, or W2s for the previous 2 years. To confirm your total assets, you can offer your account declarations for all your assets and responsibilities, consisting of: Savings and examining accounts, Investment accounts, Impressive financings, And property holdings.

Dependable Accredited Investor Financial Growth Opportunities

You can have your lawyer or CPA draft a confirmation letter, confirming that they have reviewed your financials which you satisfy the needs for a recognized capitalist. But it might be extra cost-effective to use a solution particularly designed to confirm accredited investor standings, such as EarlyIQ or .

As an example, if you register with the actual estate investment company, Gatsby Financial investment, your certified capitalist application will certainly be refined with VerifyInvestor.com at no charge to you. The terms angel investors, advanced investors, and accredited financiers are often made use of mutually, but there are subtle differences. Angel capitalists give seed money for startups and small companies for ownership equity in business.

Typically, anyone who is certified is assumed to be a sophisticated investor. Individuals and service entities who preserve high incomes or sizeable riches are presumed to have reasonable understanding of money, qualifying as sophisticated. Yes, worldwide capitalists can come to be certified by American financial criteria. The income/net worth needs stay the exact same for foreign investors.

Here are the most effective investment possibilities for certified investors in property. is when investors merge their funds to buy or renovate a property, after that share in the proceeds. Crowdfunding has actually come to be one of the most prominent techniques of spending in genuine estate online given that the JOBS Act of 2012 enabled crowdfunding systems to offer shares of real estate projects to the public.

Exceptional Accredited Investor High Return Investments

Some crowdfunded property investments don't require accreditation, however the tasks with the best prospective benefits are commonly booked for certified financiers. The distinction between tasks that approve non-accredited financiers and those that just approve recognized capitalists typically boils down to the minimal financial investment amount. The SEC presently limits non-accredited financiers, that earn less than $107,000 per year) to $2,200 (or 5% of your yearly earnings or total assets, whichever is less, if that quantity is greater than $2,200) of financial investment capital annually.

It is extremely comparable to actual estate crowdfunding; the process is essentially the same, and it comes with all the exact same benefits as crowdfunding. Actual estate syndication supplies a steady LLC or Statutory Trust fund possession design, with all investors serving as members of the entity that owns the underlying genuine estate, and an organization that assists in the task.

a company that invests in income-generating property and shares the rental earnings from the residential or commercial properties with investors in the kind of dividends. REITs can be openly traded, in which situation they are regulated and available to non-accredited financiers. Or they can be private, in which instance you would require to be approved to spend.

World-Class Accredited Investor Platforms for Accredited Investor Opportunities

It is necessary to keep in mind that REITs generally include a number of fees. Administration costs for a personal REIT can be 1-2% of your overall equity yearly Acquisition fees for new acquisitions can come to 1-2% of the purchase price. Management costs can total (exclusive deals for accredited investors).1 -.2% yearly. And you may have performance-based fees of 20-30% of the exclusive fund's revenues.

But, while REITs concentrate on tenant-occupied residential properties with stable rental revenue, exclusive equity real estate firms concentrate on realty advancement. These firms usually create a story of raw land into an income-generating property like a house complex or retail shopping mall. As with private REITs, capitalists in exclusive equity ventures typically need to be recognized.

The SEC's definition of certified capitalists is developed to identify individuals and entities regarded monetarily advanced and qualified of evaluating and getting involved in specific kinds of private financial investments that may not be readily available to the general public. Value of Accredited Financier Status: Final thought: In conclusion, being a certified capitalist lugs substantial significance worldwide of financing and financial investments.

Unparalleled Accredited Investor Crowdfunding Opportunities for Accredited Investors

By meeting the standards for recognized investor standing, people show their monetary sophistication and access to a globe of investment chances that have the prospective to produce considerable returns and add to long-term financial success (accredited investor platforms). Whether it's spending in startups, property endeavors, personal equity funds, or other different properties, recognized investors have the privilege of discovering a diverse range of investment choices and developing wide range on their very own terms

Certified capitalists include high-net-worth people, financial institutions, insurer, brokers, and trust funds. Approved financiers are defined by the SEC as certified to purchase facility or advanced sorts of safeties that are not very closely managed. Specific criteria must be fulfilled, such as having an ordinary annual revenue over $200,000 ($300,000 with a partner or cohabitant) or operating in the financial sector.

Unregistered securities are inherently riskier because they do not have the regular disclosure requirements that come with SEC registration., and various deals involving complicated and higher-risk financial investments and instruments. A company that is seeking to elevate a round of financing might decide to straight approach certified investors.

Latest Posts

Delinquent Property Tax Notice

Delinquent Property Tax List

Tax Lien Investing Colorado